We buy apartments in "rising star" markets and asset manage to maximize NOI.

IMG buys apartment communities located in emerging U.S. cities characterized by:

- population growth

- low unemployment/Expansion in skilled jobs

- increasing rent trends

- attractive lifestyle features

- a healthy local and regional economic climate

- proven public commitment to infrastructure

These qualities, known as “intrinsic values,” are just one of three critical components to our investment success. IMG buys Intrinsic value at an attractive Price per pound in dynamic locations that are Affordable for renters.

Every asset in our portfolio is acquired with this approach and managed in alignment with IMG’s investment philosophy—to deliver cash flow and equity growth over the long term by enhancing the resident experience.

TYPICAL INVESTMENT PROPERTY

- Type: Multifamily

- Class: A- to B- properties

- Size: 150 – 350+ Units

- Transaction Size: $25 million–$70+ million

TARGETED GROWTH MARKETS

- Southeast: Atlanta, Raleigh, Charlotte, Greenville, Nashville

- South: San Antonio, Austin

- West: Seattle, Portland, Denver

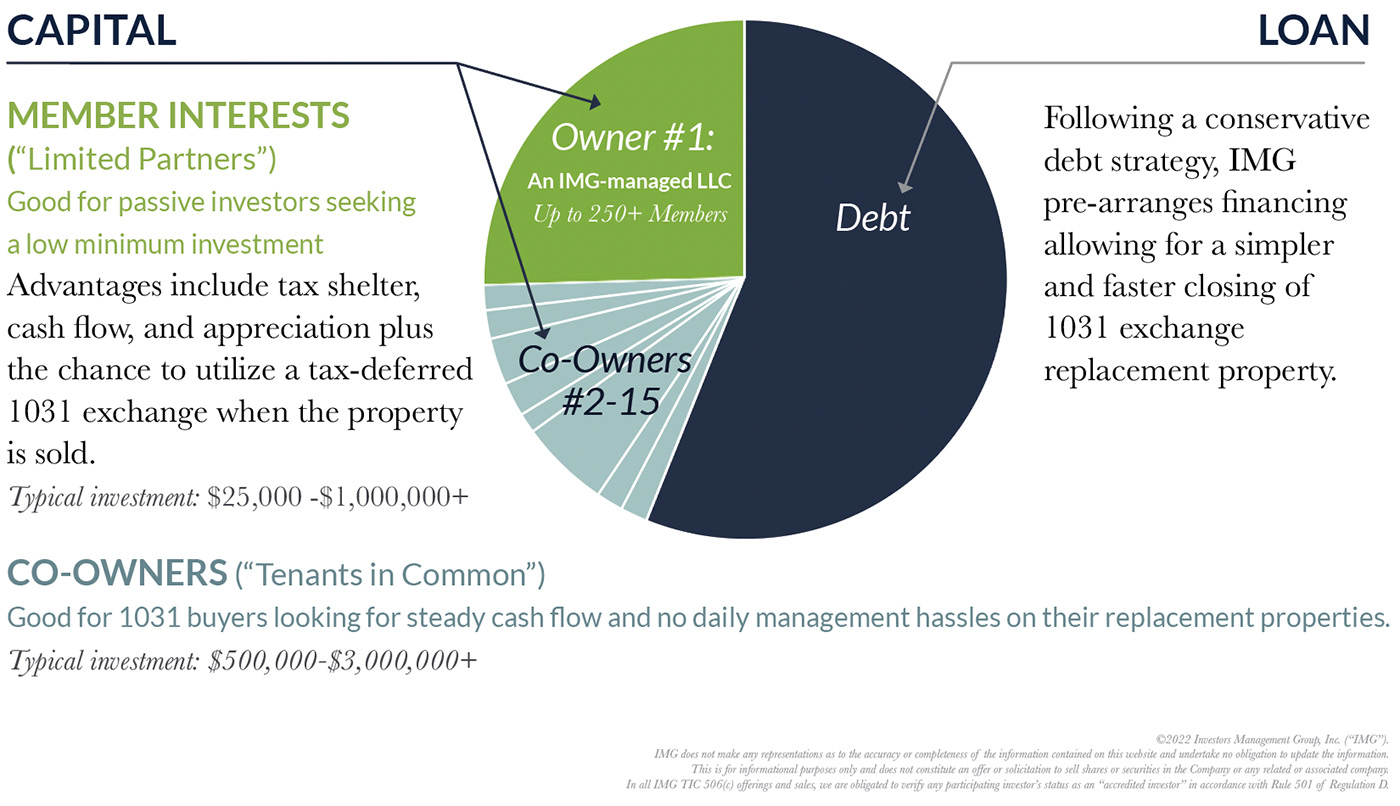

CO-OWNERSHIP: A 'STRENGTH IN NUMBERS' APPROACH

Real estate syndication is an effective way for accredited investors to combine their financial resources and acquire multifamily properties much bigger than they could afford (or manage) on their own. Think of it as a strength in numbers approach - "A group of us go in and buy something together."

IMG is a unique real estate sponsor in terms of how we structure property ownership. We purchase apartment communities with Tenants in Common and Limited Partner investors. This ownership structure offers individual accredited investors advantages like favorable treatment from depreciation, interest, and expense write-offs plus capital gains deferral through a process called a 1031 exchange.