Learning Center

IMG’s Investor Relations team, led by industry expert Karlin Conklin, answers our top investor FAQs.

“We believe that by choosing the right markets, and taking a long-term approach, multifamily assets can serve as a stabilizing force in an investor’s portfolio during a time of global turbulence.” -Neil Schimmel, IMG CEO

Every changing market cycle offers opportunities for those in a position to invest in real estate. Contact our Investor Relations team to learn how IMG’s apartment investments may benefit your financial goals.

Syndication is the pooling together of investor equity. Think of it as a strength in numbers approach - "A group of us go in and buy something together."

Real estate syndication is an effective way for accredited investors to combine their financial resources and acquire multifamily properties much bigger than they could afford (or manage) on their own.

Under the federal securities laws, only accredited investors may participate in 506(c) securities offerings. This is to ensure that all participants are financially sophisticated and able to sustain the potential risk of loss.

The U.S. Securities and Exchange Commission defines an “accredited investor” as:

- an individual with a net worth or joint net worth with a spouse or spousal equivalent of at least $1 million, not including the value of his or her primary residence

- an individual with income exceeding $200,000 in each of the two most recent calendar years or joint income with a spouse or spousal equivalent exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year

- an enterprise in which all the equity owners are accredited investors

- a trust with assets exceeding $5 million, not formed only to acquire the securities offered, and whose purchases are directed by a person who meets the legal standard of having sufficient knowledge and experience in financial and business matters to be capable of evaluating the merits and risks of the prospective investment

- an individual holding in good standing any of the general securities representative license (Series 7), the investment adviser representative license (Series 65), or the private securities offerings representative license (Series 82)

- a knowledgeable employee, as defined in rule 3c-5(a)(4) under the Investment Company Act, of the issuer of securities where that issuer is a 3(c)(1) or 3(c)(7) private fund or

- an SEC-registered broker-dealer, SEC- or state-registered investment adviser, or exempt reporting adviser

- an employee benefit plan (within the meaning of the Employee Retirement Income Security Act) if a bank, insurance company, or registered investment adviser makes the investment decisions, or if the plan has total assets in excess of $5 million

- a tax-exempt charitable organization, corporation, limited liability corporation, or partnership with assets in excess of $5 million

- a director, executive officer, or general partner of the company selling the securities, or any director, executive officer, or general partner of a general partner of that company

- a family office and its family clients if the family office has assets under management in excess of $5 million and whose prospective investments are directed by a person who has such knowledge and experience in financial and business matters that such family office is capable of evaluating the merits and risks of the prospective investment

- a plan established and maintained by a state, its political subdivisions, or any agency or instrumentality of a state or its political subdivisions, for the benefit of its employees, if such plan has total assets in excess of $5 million

- a bank, savings and loan association, insurance company, registered investment company, business development company, or small business investment company or rural business investment company

Please visit SEC.gov for more information on qualifying methods and net worth calculation.

To complete the investment process with us, an investor accreditation letter dated within the last 90 days is required. You can download a template at our resources page or verify your status online at no cost immediately following your document e-signing process via our secure and fully integrated service partner, Verify Investor.

Please review our complete list of verification methods and resources at: imgre.com/verify or contact us at investor.relations@imgre.com with any questions.

A real estate sponsor:

- guides all aspects of the acquisition process, including property due diligence and market research

- structures the capital stack, both investor equity and debt financing to acquire the property

- oversees operations as the property manager and/or the asset manager

- delivers asset performance reports to the investor group throughout the ownership period

- positions the property for an eventual sale

No.

IMG has outstanding relationships with nationally recognized exchange accommodators that we can gladly refer you to as a resource. However, our company does not provide accommodator services. Our specialty is sourcing replacement properties for our clients’ 1031 exchanges.

The IRS requires a neutral third party to be used for facilitating the 1031 exchange. This service is commonly known as a facilitator, qualified intermediary, or accommodator.

Additional resource:

TIC stands for Tenancy in Common.

Tenancy in Common describes a particular type of real estate ownership. It means there are multiple investors (co-owners, or "tenants") who each own a percentage interest and hold title in a property.

Additional resources below:

- Learn More at IRS.gov

- What is the difference between a DST and TIC? - IMG's Karlin Conklin in GlobeSt

No.

After a property is acquired, IMG oversees the asset and makes improvements to the apartment community. These improvements compound to create better performance of the asset, and ultimately an improved experience for our residents. Our investors enjoy this "hands-off" ownership experience and consistent monthly income stream.

Detailed property performance reports, personal investment information and annual tax forms are all accessible through IMG’s online investor portal.

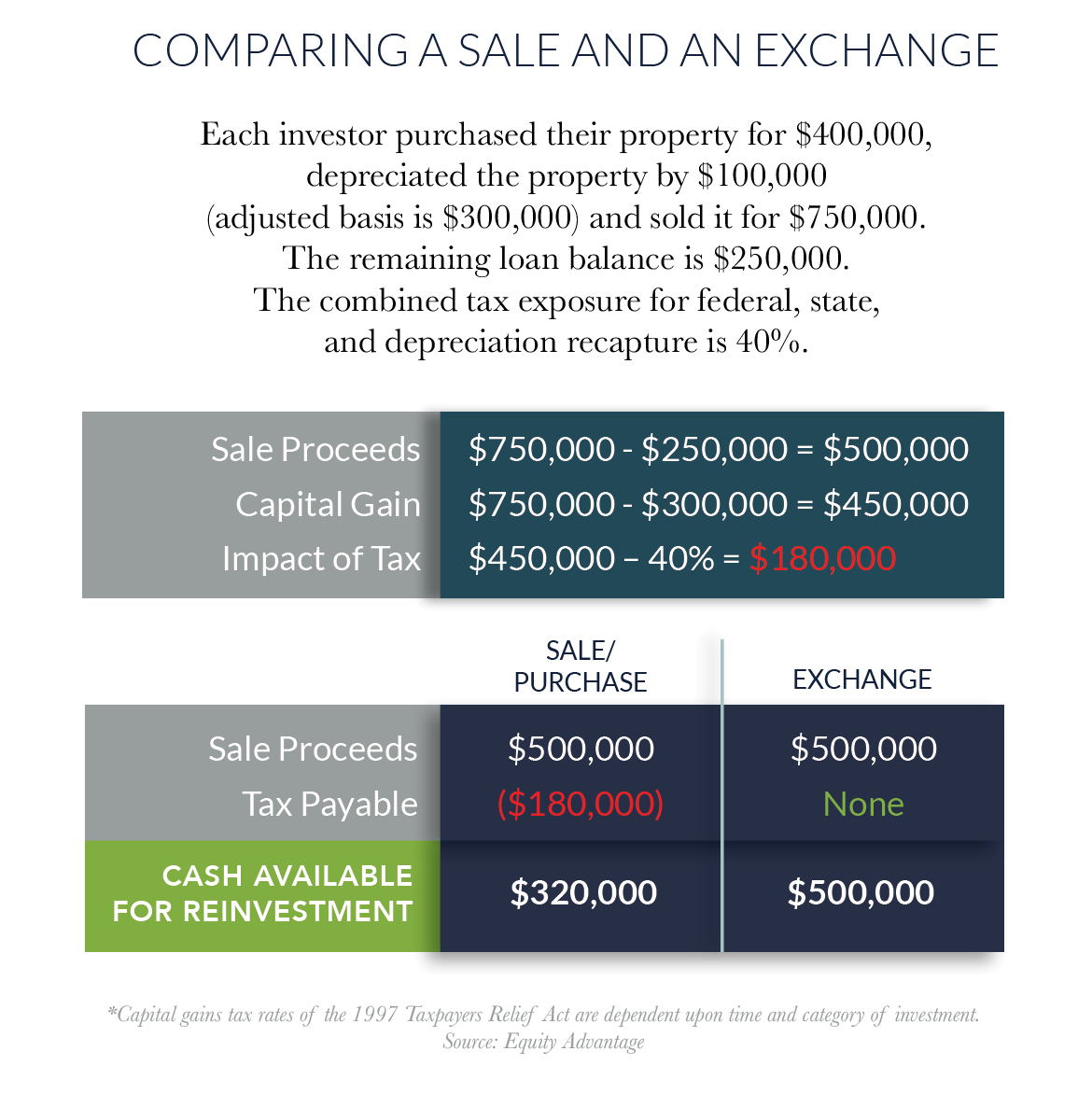

The US tax code gives real estate investment and ownership favorable treatment from depreciation, interest and expense write-offs, to capital gains deferral through the 1031 exchange process.

The term "1031 exchange" comes from Section 1031 of the U.S. Internal Revenue Code. To put it simply, it allows an investor to “defer” paying capital gains taxes on an investment property when it is sold, as long as another “like-kind property” is purchased with the profit gained by the sale of the first property within very strict timelines.

The proceeds from the sale must go through the hands of a qualified intermediary, commonly known as an "exchange accommodator". Otherwise, your sale proceeds will become taxable. Any cash proceeds retained from the sale are taxable.

Watch IMG Insights Tax Benefits Mini-Series:

Yes.

A self-directed IRA or an IRA LLC (known as a "checkbook” IRA) allows you the freedom to invest in real estate including single-family and multifamily (commercial) property. This strategy for equity growth continues to grow in popularity.

There are several custodians you may choose from including Forge Trust and Provident. Once your SD-IRA account is established, IMG will work with you and your custodian to place the investment.

Note that processing an investment through an IRA can take some time, so ideally we begin the process 4-6 weeks prior to our investment offering closing date.

Additional resource:

How to Use a Self-Directed IRA to Invest in Real Estate Karlin Conklin, Kiplinger Contributor

Throughout modern history, housing assets as long-term investment vehicles have offered greater returns with less risk than traditional investments. Based on both substantial, in-depth research data and personal investing experience, IMG believes in multifamily as the most compelling commercial real estate asset class:

- Recognized hedge against inflation

- Competitive returns vs. other asset classes

- Favorable supply/demand balance

“Apartments are still the most compelling product type in commercial real estate. The key reason for this is simple, if trite: People always need a place to live.”

— Forbes

"When the economy is down and commercial businesses close, people still need places to live, that doesn’t change. Of course there are market swings in multifamily, but there’s generally a demand for it on some level or in some market."

—GlobeSt

IMG provides an opportunity for you to:

- invest in larger or more exclusive real estate properties with the potential for better returns

- enjoy predictable cash flow from real estate investments without the hassles of hands-on management

- understand your investment’s performance through transparent and open communication

- utilize favorable tax treatment associated with real estate ownership for deferral of capital gains and income sheltering

- grow equity over the long term in well-located apartment properties, known to provide the best risk-adjusted returns in the industry

- benefit from connections within a group of successful real estate investors

We’re honored that over 80% of our investors choose to reinvest their equity with us.

As an asset manager, IMG:

- supervises third-party property management

- conducts property budgets and reports

- negotiates contracts

- construction manages property renovations

- reports transparently to owners on a monthly and quarterly basis

Working directly with our third-party property managers, we can quickly pinpoint inefficiencies, identify actionable next steps and maximize investment dollars across our national $1B portfolio.

Watch: IMG Insights - Asset Management vs. Property Management Explained

Asset management and property management are often mistaken as interchangeable terms, but they are actually distinct roles within the commercial real estate industry, each serving a unique yet interconnected purpose.

Property management focuses on the day-to-day operations and maintenance of a specific property or properties within a multifamily portfolio. In rental housing, this involves tasks such as tenant relations, rent collection, maintenance, leasing, and ensuring the property meets regulatory requirements and standards.

Asset managers oversee property managers and are responsible for financial analysis, investment strategy, capital improvements, portfolio optimization, and risk management.

Watch: IMG Insights: Asset Management & Property Management Explained

IMG has delivered to its partners an average 2.0x equity multiple and 26% IRR over 27 full-cycle investments since 2010.

Yes.

Each apartment asset in the IMG portfolio is aligned with our own investment goals—to enhance the resident experience plus deliver value and equity growth over the long term. IMG’s leaders confidently place their own personal equity into every IMG multifamily syndication.

Throughout the full life cycle of your investment, you will visit your IMG Investor Portal dashboard to access:

- Current performance metrics

- Monthly and quarterly investment reports

- Tax documents

- Distribution statements

- Special announcements

- Personal profile settings (e.g. change of address)

Note: The IMG Investor Portal, powered by RealPage, has been architected to prevent security breaches by using banking and military level encryption. It is hosted in the largest and most advanced cloud infrastructures, provided and used by other financial services companies such as Capital One, Pacific Life and Intuit.

No.

As Sponsor, IMG simply facilitates the pooling of your investment with other passive investors’ funds to purchase a tangible commercial real estate asset.

First, you’ll review our offering documents. Then, you decide the amount you wish to invest. You may track the performance of your investment through the IMG Investor Portal dashboard. To manage where your distributions are received, visit your investor portal Manage Profiles > Payment Methods section.

There are two types of tax forms you may receive annually (by mid-March):

MEMBERS OF IMG-MANAGED LLCS

Members receive their investment’s Schedule K-1, which allocates partner’s share of income, deductions, credits, etc.

TENANTS IN COMMON

Co-owners receive Tax Compilations for Schedule E reporting.

Members and Tenants in Common can access/download IMG tax forms at our website:

1. Click Investor Login

2. At the top-left, click My Portfolio and select "Documents"

3. Select desired filter options, such as Type > Tax Documents or by Date Range.

Please notify us of any form corrections or assistance needed at investor.relations@imgre.com.

To request IMG's multifamily investment offering announcements, email investor.relations@imgre.com or call (747) 262-5660 for more information.

Accredited investors are encouraged to create or update your IMG Investor Portal account and complete an investment profile to prepare for participation in our next investment offering. Offering announcements will be sent to the email address you provide as your IMG Investor Portal account login.

To ensure delivery of our email communications, please add David.Mikkelsen@imgre.com, Karlin.Conklin@imgre.com, and Natalie.Olmos@imgre.com in your email program contacts as Safe Senders.

Our apartment investment offerings are sold as 506(c) securities to accredited investors on a first-fund basis.

To ensure optimal receipt of our communications, add us to your trusted list of senders, contacts or address book:

- Dave Mikkelsen - david.mikkelsen@imgre.com

- Karlin Conklin - karlin.conklin@imgre.com

- Natalie Olmos - natalie.olmos@imgre.com

- Investor.Relations@imgre.com

Communications are sent to you at the email address you provide as your IMG Investor Portal account login. Please ensure this is your primary email account. Updates will come from Karlin Conklin, Dave Mikkelsen, and Natalie Olmos. Add them to your contacts and designate them as "safe senders."

If you have previously Unsubscribed from our email list, and you wish to re-subscribe, please email your Re-subscription Request to investor.relations@imgre.com.