News

IMG Markets Rank Favorably in ULI’s 2021 Emerging Trends

The 42nd Annual Emerging Trends in Real Estate® report starts discerning the trends that COVID-19 has instigated and their long-term potential

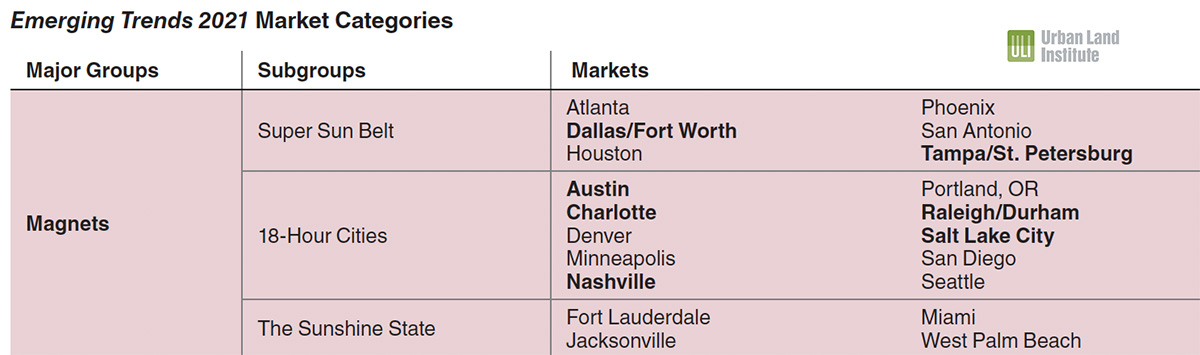

Woodland Hills, CA— October 24, 2020— ULI published its highly regarded annual report analyzing trends and outlooks for the multifamily real estate industry. IMG’s acquisition markets rank favorably for in-migration and demand, including Raleigh (No.1), Charlotte (No. 5) and Tampa (No. 6).

The annual report by the Urban Land Institute and PwC is based on surveys and interviews with more than 1,600 industry experts including investors, fund managers, developers, property companies, lenders, brokers, advisers and consultants.

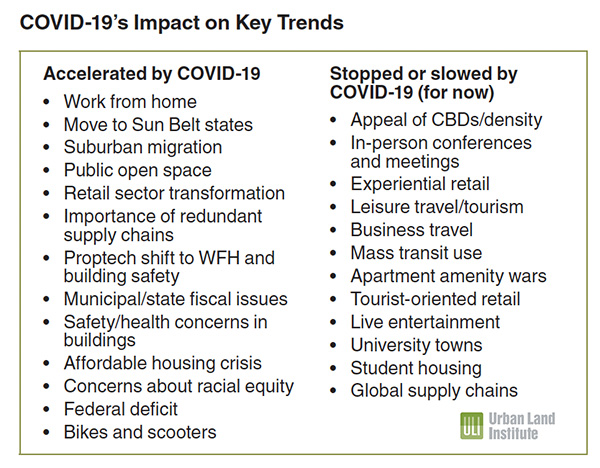

Trends in the 2021 report highlight an acceleration in:

- Working from home/Remote work

- A population shift to ‘Sun Belt’ states

- Suburban migration – Heightened desirability of lower density areas

- Demand for public open space and parks

“The pandemic has been an equalizer; our focus is on identifying the markets that will lead in the next normal.”

TOP REAL ESTATE MARKETS FOR 2021

*1. Raleigh/Durham

2. Austin

3. Nashville

4. Dallas/Fort Worth

*5. Charlotte

*6. Tampa

7. Salt Lake City

8. Washington DC

9. Boston

10. Long Island

*11. Atlanta

*12. San Antonio

*13. Denver

14. Northern New Jersey

15. Phoenix

*Active IMG Investment Markets

Raleigh/Durham has earned the nickname “Bay Area of the East Coast” due to the surge in tech jobs and the area’s reputation as a research and education mecca.

For markets like New York City and Los Angeles, “The next three to five years could be difficult as demographics favor suburban locations, and restrictions on public transit, office and retail/restaurant density, and live entertainment—and individuals’ concerns about them—make big-city life less appealing.”

Markets to Watch

View/Download ULI 2021 Emerging Trends – Full Report

For information about IMG‘s apartment investment opportunities, call us at (747) 262-5600.