News

First-of-its-kind study reveals surprising rent-to-income ratios

Data From Millions of Apartment Leases Shows Renters Spend 23% of Income on Rent

According to a first-of-its-kind study from RealPage, affordability for market-rate apartments is not a major concern for owners as income wage growth is moving along with rent increases.

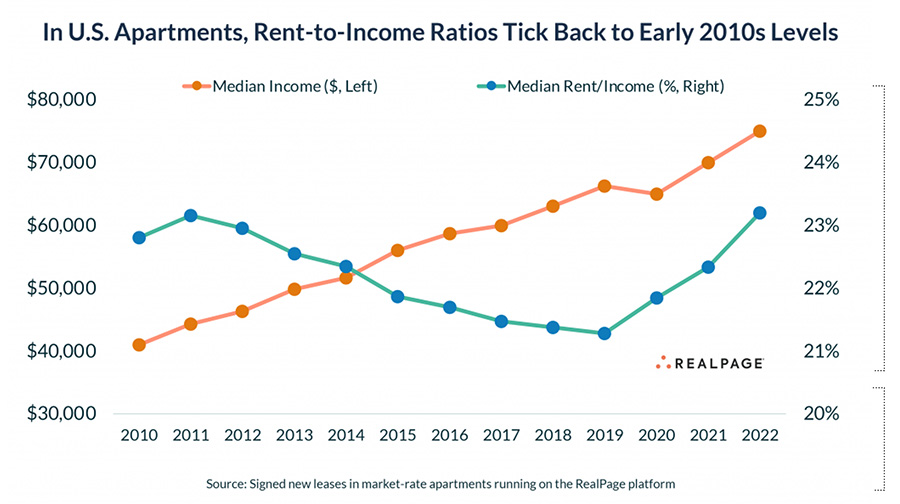

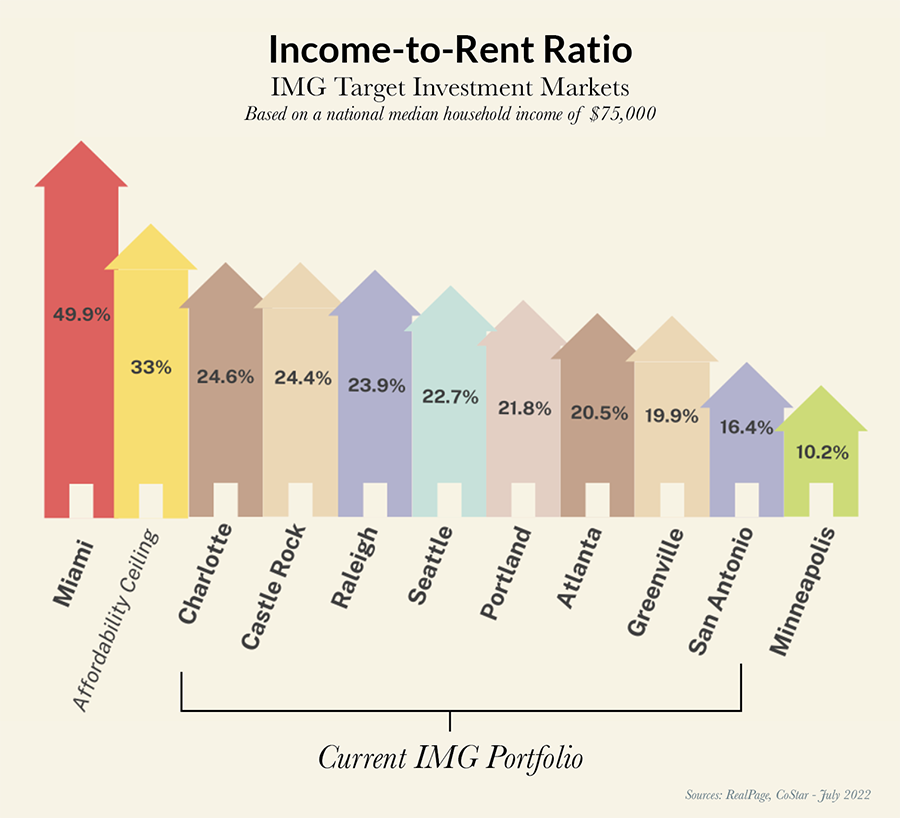

The 2022 Market-Rate Apartment Affordability Report issued in July revealed that market-rate residents nationwide are spending 23.2% of their income on rent, well below the traditional affordability ceiling of 33%.

This study into one of the largest segments of the U.S. rental housing market reveals a surprising driver keeping rental distress – and evictions – low: A majority of renters are able (and willing) to pay the rent.

Continued inflation has put a spotlight on housing affordability in recent months. Like nearly all expenses in today’s inflationary market, rents are growing at the fastest pace in more than 40 years. So far in 2022, the median monthly rent on a new lease jumped 21.9% to $1,510, nationally.

In a statement, Carl Whitaker, RealPage’s director of research and analysis, said, “Apartment renters are spending slightly more on rent than they did prior to the pandemic, but many could still get stretched as other expenses, particularly food and gas, climb at much faster rates.”

The report also concluded that the percentage of billed rent collected has consistently averaged between 95% to 96% since March 2020. Prior to the start of the pandemic, collections trended slightly higher at 96% to 97%.

“High collection rates in the market-rate apartment sector are one reason why rental delinquency and eviction filings never spiked nearly as much as some had feared,” noted Whitaker.

Addressing a Severe Shortage of Housing Stock

Multifamily industry experts agree that market-rate affordability is not the biggest cause for concern – Rather, it’s the severe lack of housing stock.

As RealPage’s chief economist Jay Parsons noted, “The real problem is the severe shortage of true affordable housing for the millions of households who cannot afford to rent or buy. That is a separate challenge that is too often conflated with affordability among existing market-rate renters. We need a lot more housing across the country, especially affordable housing.”

The RealPage 2022 Market-Rate Apartment Affordability Report captured household income and leasing rate data on nearly 7 million individual leases nationally. RealPage’s study focused only on renters in market-rate, professionally managed apartments signing a new lease (within RealPage software). Past studies have mixed-matched rental rate and wages datasets, creating a misleading view on affordability.

The full report can be viewed here.

About RealPage

Founded in 1998, RealPage provides data analytics, property management software, and services to efficiently manage rental properties and real estate. RealPage currently serves over 19 million units worldwide from offices in North America, Europe, and Asia.

View All Recent News

View IMG’s Current Investment Offerings