WHAT WE DO

Multifamily is our exclusive focus at Investors Management Group. By concentrating our expertise and resources in this specific commercial real estate sector, we have gained an in-depth understanding of navigating the complexities in all aspects of the investment lifecycle.

IMG's principals have taken their combined decades of successful experience to create a vertically integrated, investor-centric team that can unlock the full potential of each multifamily investment property we acquire.

From sourcing and due diligence to asset and property management to disposition, we have built a comprehensive platform that ensures seamless coordination and maximizes value for our tenants and clients.

REAL ESTATE INVESTMENT

As a sponsor, IMG:

- finds the investment property

- assembles investor capital and financing to acquire the property

- oversees all aspects of due diligence for our investor group

- oversees management and capital improvements to the property as the asset manager

- distributes cash flow to our investor group

- communicates asset performance to our investor group throughout the ownership period

- arranges for the sale of the property

We're dedicated to elevating the potential of every property we touch, and to enhancing the lives of those who live and work in them. Join our waitlist →

ASSET MANAGEMENT

As an asset manager, IMG:

- supervises third-party property management

- conducts property budgets and reports

- negotiates contracts

- construction manages property renovations

- tracks market trends

- executes refinancing and dispositions

- reports transparently to owners

IMG is focused on maximizing the value and return on investment of every property. This includes providing guidance for optimizing revenues, reducing expenses whenever possible and executing capital improvements. We navigate strategic decisions such as refinance and sale - always in collaboration with the co-owners. Investor login →

UNLOCKING INVESTMENT VALUE & STRENGTHENING COMMUNITIES

Effective property management is crucial to the success of any multifamily investment. IMG engages best-in-class property management in our targeted markets. Our vertically integrated approach allows us to effectively manage every aspect of the investment lifecycle.

LEADING THE WAY WITH 'IPA'

IMG buys apartment communities located in growing U.S. cities characterized by:

- population growth

- low unemployment/Expansion in skilled jobs

- affordable yet increasing rent trends

- attractive lifestyle features

- a healthy local and regional economic climate

- proven public commitment to infrastructure

These qualities, known as “intrinsic values,” are just one of three critical components to our investment success. IMG buys Intrinsic value at an attractive Price per pound in dynamic locations that are Affordable for renters.

Every asset in our portfolio is acquired with this approach and managed in alignment with IMG’s investment philosophy—to deliver equity growth over the long term by enhancing the resident experience.

IMG has earned national acclaim for the predictable execution of multifamily investment and asset management following our signature ‘IPA’ acquisition strategy. Read more in Multi-Housing News →

TYPICAL IMG INVESTMENT PROPERTY

- Type: Garden-style Multifamily

- Class: A- to B- properties

- Size: 150 – 350+ Units

- Transaction Size: $25 million–$70+ million

TARGETED GROWTH MARKETS

- Southeast: Atlanta, Raleigh, Charlotte, Greenville, Nashville

- South: San Antonio, Austin

- West: Seattle, Portland, Denver

CO-OWNERSHIP: A 'STRENGTH IN NUMBERS' APPROACH

Real estate syndication is an effective way for accredited investors to combine their financial resources and acquire multifamily properties much bigger than they could afford (or manage) on their own. Think of it as a strength in numbers approach - "A group of us go in and buy something together."

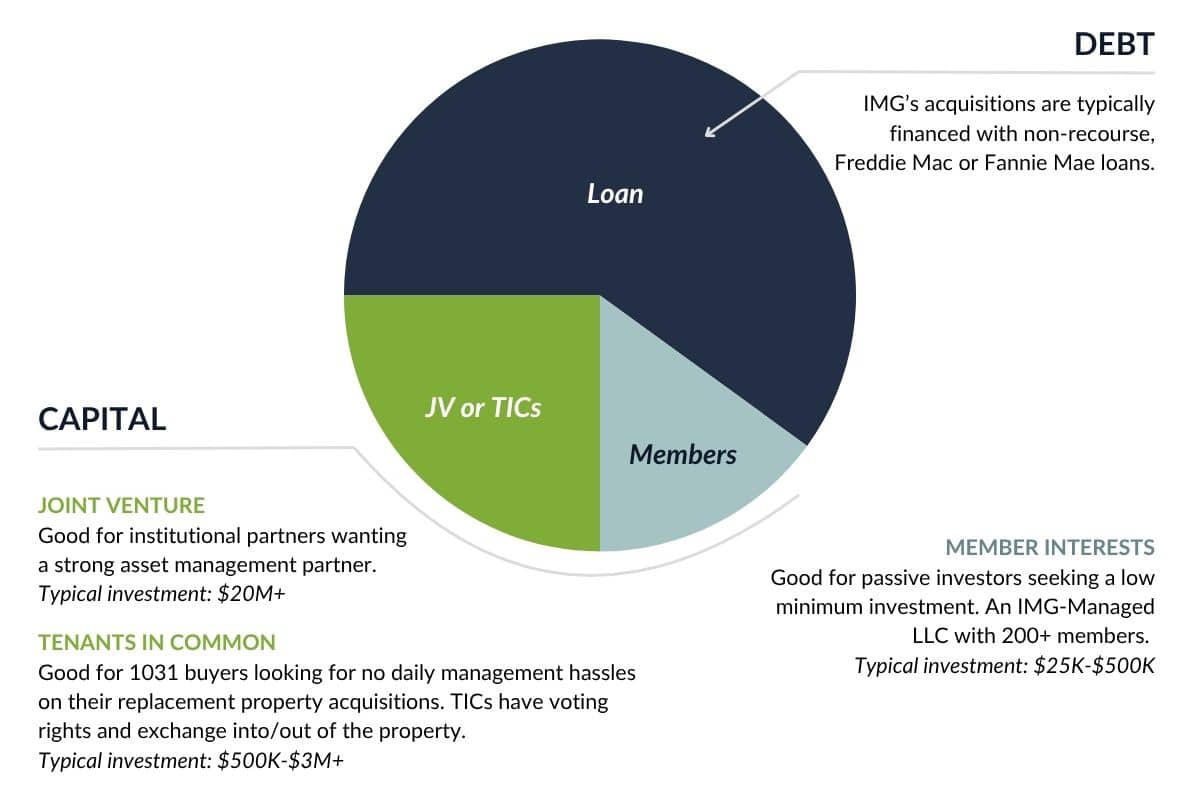

Investors Management Group utilizes joint venture ("JV") and Tenancy in Common ("TIC") ownership structures.

Tenancy in Common allows a group of investors, or co-owners, to hold a percentage interest in the property. Each is named on title and is a co-borrower on the loan. Co-owners can utilize 1031 exchanges upon property sale, allowing for tax deferral. IMG’s TIC offerings are structured as 506c securities.

Joint Ventures leverage the combined strengths of the sponsor’s expertise and the investor’s capital, maximizing returns for both parties. While the investor makes strategic decisions, the sponsor’s business execution drives performance and incentivizes successful real estate operations.

We personally co-invest on the same terms as our clients in every property we acquire, so you know our objectives are aligned.

Rental Housing’s Significant Contribution to Local Economies

Apartment investors like Investors Management Group are making a positive impact in the infrastructure of local neighborhoods and economies by improving the quality of rental housing.

VALUE-ADD INVESTMENT CASE STUDY

- Investor IRR: 16.5%

- Equity multiple: 1.94x

IMG had a vision to reposition this unique, low-density 22-acre property in a high-demand South Tampa submarket, just half a mile from Bayshore Boulevard’s waterfront and luxury estates.

Over $3M in upgrades transformed this 1980s-built community with exterior paint, landscaping, a renovated leasing center, lakeside lounge, hammock park, and enhanced poolside and bark park areas.

Operations surged during the repositioning period, with net income growing 69% over the five-year hold period.

After two years of ownership, IMG directed a refinance event that generated $2.9M in proceeds or 21% of original investor capital.