Our Portfolio

SOLD: 276 Units — Tampa

Year built: 1988

Location: Tampa, Florida

Purchase price (2018): $40 million

Equity invested: $14 million

CapEx budget: $3 million

Sold: July 2023

Sale price (2023): Undisclosed

- Investor IRR: 16.5%

- Equity multiple: 1.94x

Investment Highlights

Constructed in 1988 as a low-density community on 22 acres, IMG acquired Solis with a vision to reposition the unique property within a high-demand Tampa submarket.

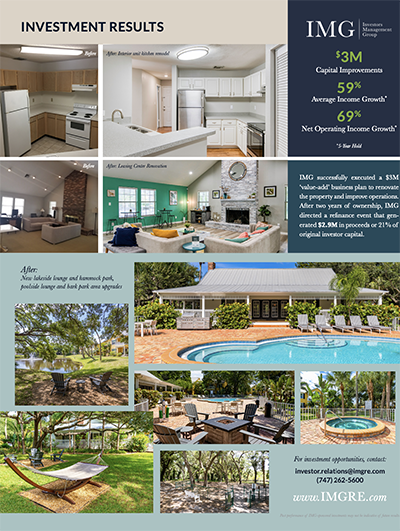

The property occupies a prime location just half a mile from Bayshore Boulevard, known for its waterfront promenade and million-dollar estates. The $4B Water Street Tampa redevelopment taking place a few miles from the property underscores the growth and desirability of the area. IMG successfully executed a $3M 'value-add' business plan to renovate the property and improve operations.

IMG identified this South Tampa submarket as having intrinsic qualities that could draw in-migration and diversified job growth. With major employers like MacDill Air Force Base minutes away, the community consistently delivered high occupancy and rent growth. Due to the strong rental demand, strategic property improvements, and focused management, property income increased by 59% over five years.

After two years of ownership, IMG directed a refinance event generating $2.9M in proceeds or 21% of original investor capital. After capitalizing on our business plan during a five-year hold period, the sale represented another example of IMG delivering returns to clients that exceeded original projections.

This property’s attractive purchase price, intrinsic value and affordability aligned with IMG’s nationally acclaimed IPA™ acquisition strategy. We have successfully used this approach to acquire and operate multifamily investments to achieve outsized returns for our clients over more than 20 full-cycle transactions.